Crypto ETF inflows drive Bitcoin recovery amid altcoin weakness

Bitcoin (BTC) steadied above $108,000 on Wednesday after facing resistance at $114,000 the previous day, fueled by renewed crypto ETF inflows. Institutional demand, reflected in inflows to Bitcoin and Ethereum spot ETFs, provides a short-term bullish outlook despite broader market uncertainty.

Meanwhile, Ethereum (ETH) and Ripple (XRP) are showing weakness as profit-taking, macroeconomic concerns, and a lack of strong price catalysts weigh on their performance.

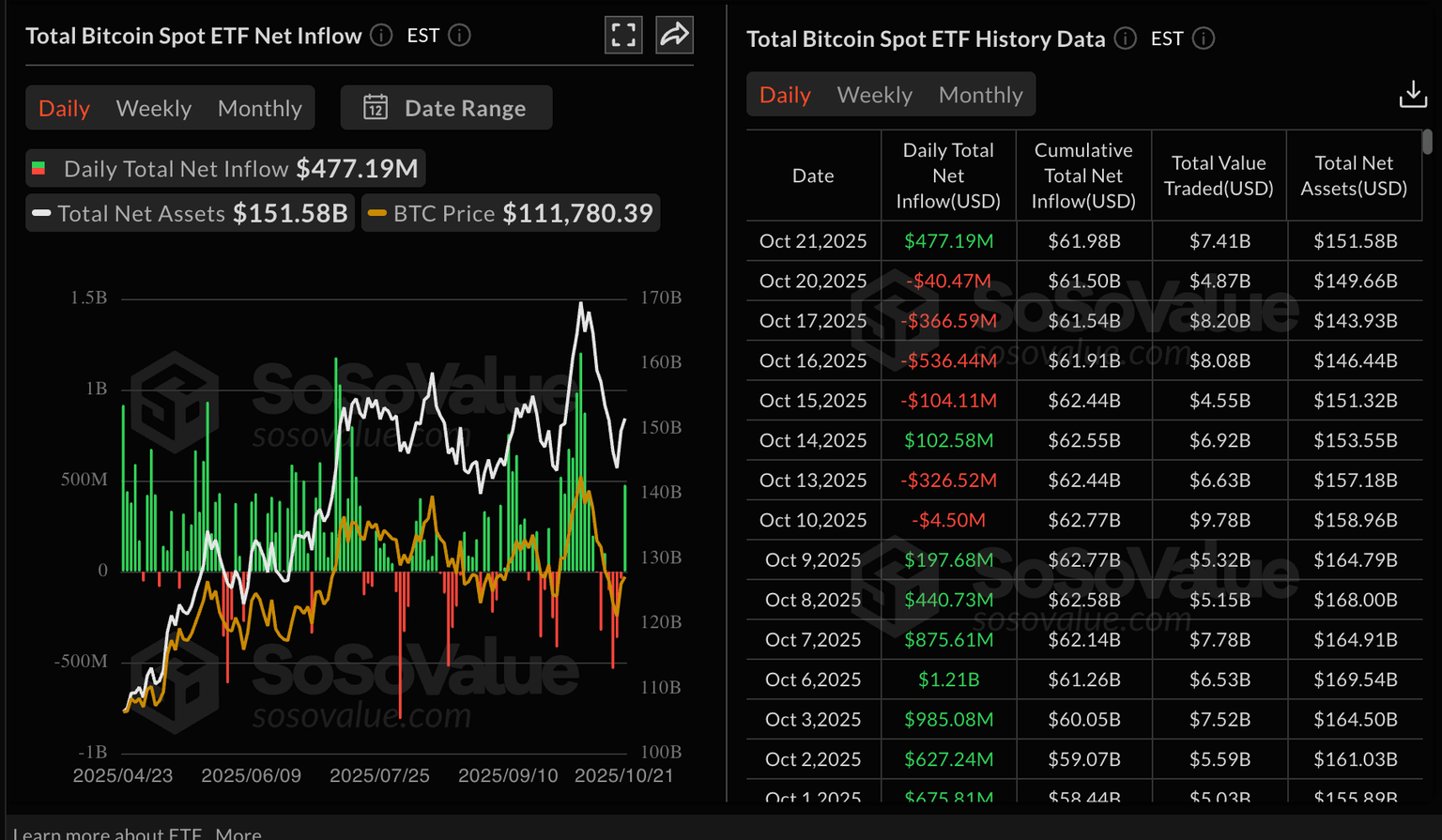

Bitcoin ETF Inflows Signal Strong Institutional Demand

US-listed Bitcoin spot ETFs saw inflows of around $477 million on Tuesday, breaking a four-day streak of outflows. The cumulative net inflow has reached approximately $62 billion, highlighting steady interest from institutional investors.

ETFs often act as key drivers for Bitcoin’s rally, as continued inflows can absorb selling pressure and increase the probability of a rebound toward the $114,000 resistance level.

Ethereum ETF Inflows Indicate Risk-On Sentiment

Ethereum spot ETFs recorded inflows of nearly $142 million on Tuesday, signaling some risk-on sentiment for the largest smart contract platform. The total cumulative net inflow for Ethereum ETFs stands at $15 billion, with net assets averaging $27 billion.

Maintaining ETH above the $4,000 level will require continued ETF inflows, which can bolster investor confidence and potentially attract more retail participation.

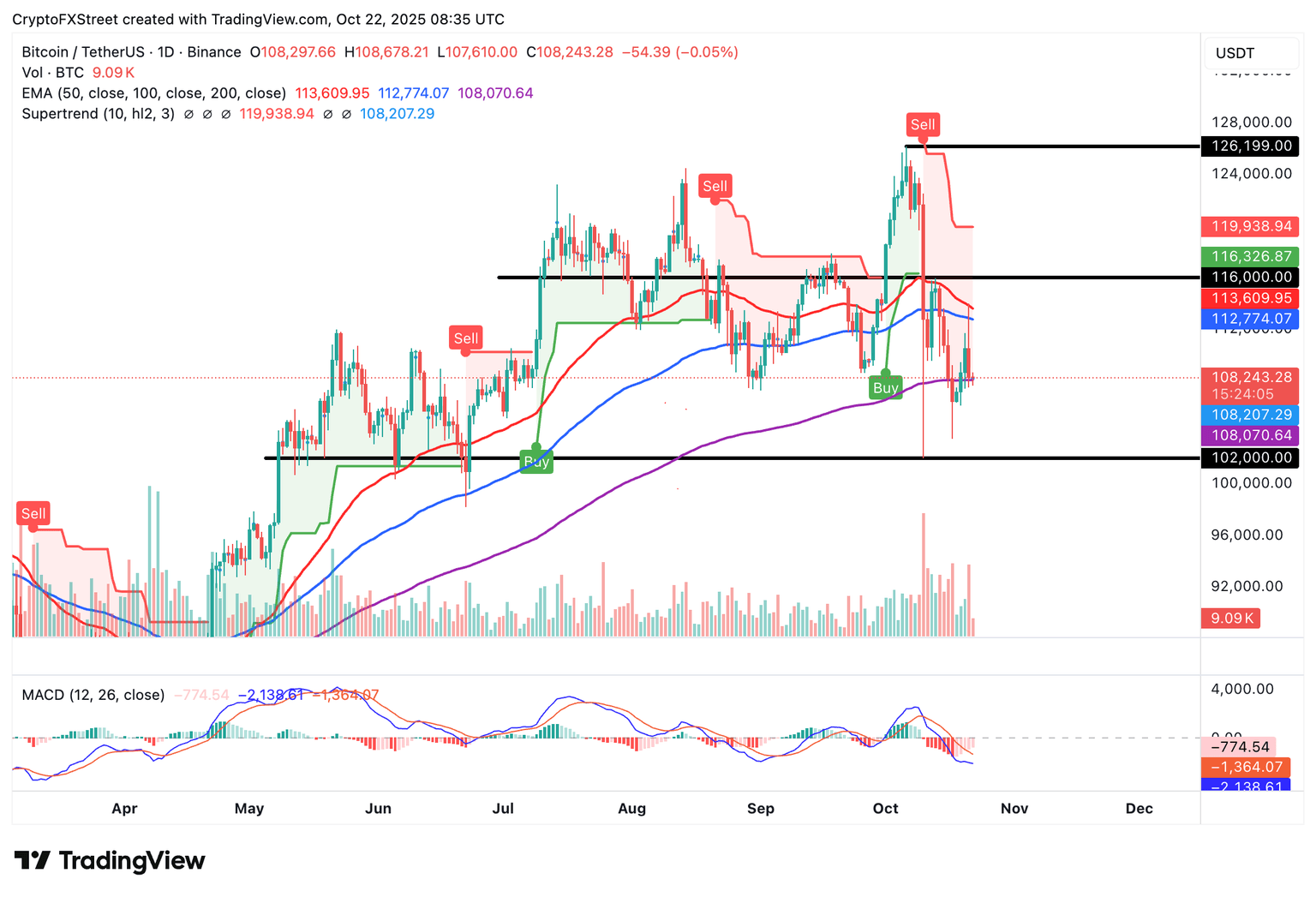

Technical Overview: Bitcoin Faces Resistance

Bitcoin is trading above the 200-day EMA at $108,070, yet bulls are struggling after the $114,000 rejection. Indicators like MACD and SuperTrend currently show a bearish bias, increasing the likelihood of a short-term decline toward October lows near $102,000.

A daily close above the 200-day EMA would suggest stabilizing sentiment, potentially paving the way for a sustained recovery.

Altcoins Update: Ethereum and XRP Continue Decline

Ethereum has slipped below its 100-day EMA at $3,967, seeking support near $3,800. Bearish signals from MACD and a declining RSI below 50 highlight increasing downside pressure. Key support levels include $3,800, $3,680, and the 200-day EMA at $3,569.

XRP bulls are trying to reclaim $2.40, but a Death Cross pattern on the daily chart points to persistent negative sentiment. Next key support levels are $2.18 and $1.90, while potential medium-term resistance includes the 200-day EMA at $2.61 and 100-day EMA at $2.75.

Key Takeaways

Crypto ETF inflows are driving Bitcoin’s short-term recovery.

Ethereum ETF inflows show moderate institutional interest, but ETH faces technical weakness.

XRP continues to struggle amid bearish patterns, while support levels must hold to avoid further downside.

Investors should monitor ETF inflows closely, as these remain a major indicator of institutional sentiment in the cryptocurrency market.